Latest Post

- Best 10 pre wedding shoot locations in Jalandhar

- Best 10 pre wedding shoot places in Tirupati

- Best 7 Chikmagalur Pre Wedding Shoot Places

- Best 12 pre wedding shoot locations in Alibaug

- Best 8 Pre Wedding Shoot Locations in Maharashtra

- Best 9 Pre Wedding Shoot Places in Warangal

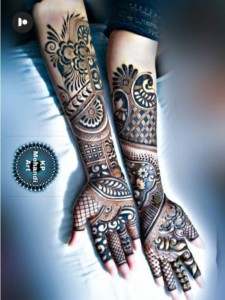

- 9 Latest Dubai Mehendi Designs

- Best 9 Mehendi Designs For Karwa Chauth

- Best 10 Simple Floral Mehendi Designs

- Best 8 Mehendi Designs For Grooms

- 9 Simple Mehendi Designs For Girls, Baby Girls

- 9 Easy Leg Mehendi Designs

- 8 Latest Arabic Mehendi Designs

- Best 9 Bridal Mehendi Designs For Engagement / Wedding

- Top 5 Pre Wedding Shoot Locations In Varanasi

- Top 5 Pre Wedding Shoot Locations in Noida

- Top 7 Pre Wedding Shoot Locations in Bhopal

- Top 6 Pre Wedding Shoot Locations in Kanpur

- Top 7 Pre Wedding Shoot Locations in Ludhiana

- Top 10 Pre Wedding Shoot Locations In Mussoorie

- Where To Buy Modest Bridesmaid Dresses for Your Special DayChoosing bridesmaid dresses that align with a modest aesthetic can present a unique set of challenges. Striking the right balance between style and conservative design requires a thoughtful approach to […]

- Faith-Based Wedding Ideas: Christian Decor, Favors, and GiftsA wedding is always a celebration, but a faith-based wedding is something even deeper. It is not only about a couple in love. It is about a couple making a […]

- Should You Rethink Outdoor Wedding Plans to Better Suit Aging Relatives?Planning an outdoor wedding can feel like the perfect choice, but when seniors are part of the guest list, comfort and safety deserve equal attention. Many older adults look forward […]

- Timeless Wedding Hairstyles That Never Go Out of StyleA bride’s hairstyle frames every photograph, punctuates every hug, and endures in memory long after the last slice of cake is gone. Trends may flirt with bold colors and avant-garde […]

- Britt Lower’s Husband Kenna Kennor On What Every Soon-to-Be-Wed Needs To Know About Wedding HairLet’s be real: wedding planning is full of choices that can make your head spin. There’s the perfect dress, the shoes you pray won’t kill your feet, and then the […]

- Destination Wedding Logistics 101: Travel, Timelines, and Guest ManagementIn general, people talk about the view, the outfits, the vibe. However, nobody really talks about the logistics until the first guest texts, “My bag is missing!” Suddenly, there is […]

- Bridal Gown Prep 101: Cleaning and Pressing Before the AisleA wedding dress is more than a garment; it is a memory in the making. When you first tried on your gown, you could almost feel the music, the flowers, […]

- Staying Calm Before “I Do”: Real Tips for Actually Relaxing the Week Before Your WeddingAlright, let’s just cut to the chase—you’ve got a stack of RSVP cards, a closet overflowing with half-finished craft projects, and at least three relatives texting to ask about hotel […]

- Affordable Editing Tricks Using Stock Video Footage for Wedding ProjectsWedding editing is a balancing act performed on a moving treadmill. You’re trying to deliver cinematic results on a real-world budget, with timelines that stack up fast and couples who […]

- Celebrating Love with the Best Anniversary Decoration by CherishXAnniversary is a day that couples carry close to their hearts. It is not about starting together an another year. It is about celebrating memories they made in past year […]

FOR Advertisement Related Queries

News

- 11 Boys Mehndi Designs: Perfect Patterns for Young Hands

- 25 Years of Love: Personalized Touches for Your Anniversary Cake

- 7 Ways to Increase The Number of Likes on Facebook

- Accessorizing Tips for Every Occasion

- Affordable Editing Tricks Using Stock Video Footage for Wedding Projects

- AI in Endodontics: Detecting Missed Canals and Periapical Lesions

- AI in Fast Food Kiosks: A Glimpse Into the Next Generation of Quick Service

- Are You Ready to Find the Perfect Bridesmaids? How to Choose Them and Show Your Appreciation!

- Bridal Gown Prep 101: Cleaning and Pressing Before the Aisle

- Britt Lower’s Husband Kenna Kennor On What Every Soon-to-Be-Wed Needs To Know About Wedding Hair

- Buy Cheap Instagram Followers! It’s Your Time!

- Can Your Beach Proposal Double as Your Dream Elopement?

- Celebrating Love: The Rise of E-Invites Invitations in India

- Choosing the Perfect Wedding Photography Style for Your Big Day: A Complete Guide

- Deco Mesh and Ribbon: Beautiful Ways to Style Wedding Décor

- Destination Wedding Logistics 101: Travel, Timelines, and Guest Management